A Bullish Market

Thoughts on the August and September stock market

By no means am I an experienced investor or someone fully understands the stock market. Please read with discretion.

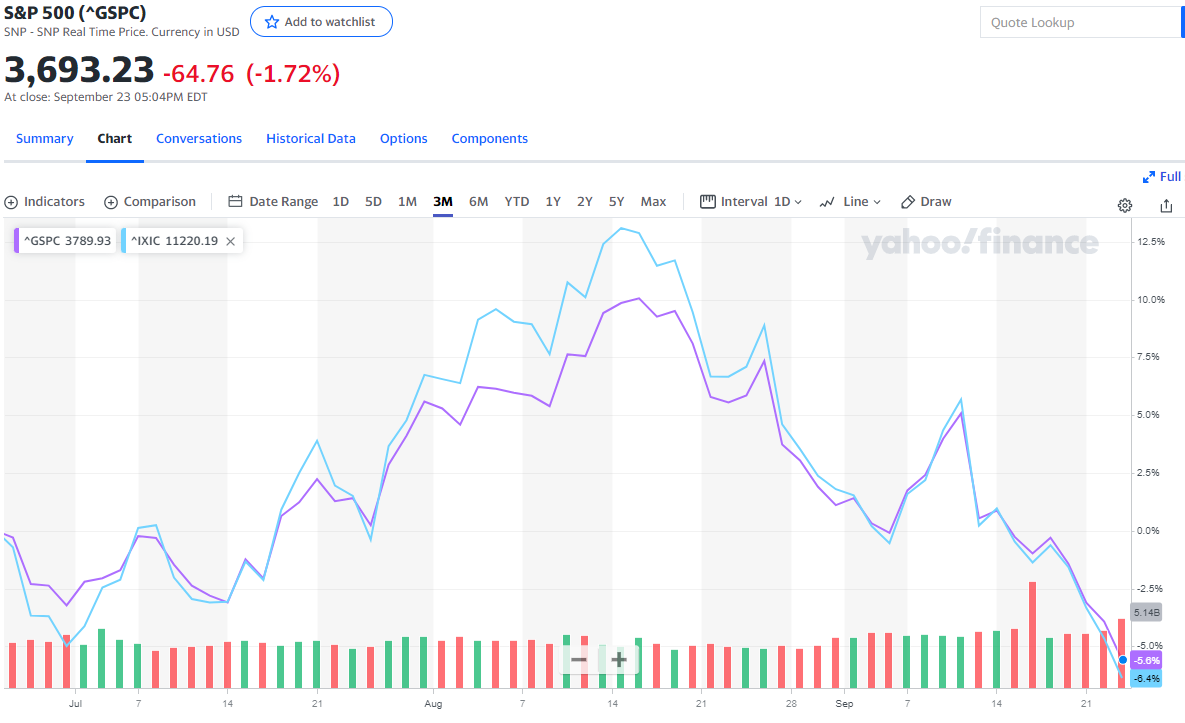

Purple representing S&P 500 and Blue representing DOW Jones

The August and September stock market sessions have been on the low. All across the board, red. The S&P 500 dropped nearly 15%1 and the DOW Jones Industrial Average dropping nearly 13%1 from their peaks around August 16th. Despite these drops, there were multiple occasions where the markets gained (as it usually fluxuates.) However, the most prominent of these gains was within the week of August 6th to 12th as the S&P 500 increased with a ~5% gain and DOW Jones Industrial Average with an increase of ~4% gain. Although this period of time was a sigh of relief for investors, the stock market changed course and plunged. Though there are multiple factors to blame, one of the most prominent would be due to FED price hikes.

As mentioned in Forbes Advisor post on September 23, 2022, “Why Is The Stock Market Down Today?” subsection “The Fed Is Getting What It Asked For”:

Ahead of this week’s Federal Open Markets Committee (FOMC) meeting, The Wall Street Journal reported that Fed officials had been pretty unhappy with the market’s >positive reaction following the July rate hike.

Between the July decision and mid-August, the S&P 500 gained 10%—even though Fed Chair Jerome Powell went out of his way to underline that the Fed was committed to >its campaign to crush inflation. The stock market, it appears, didn’t take the hint.

Powell’s displeasure with the rally was so intense that he discarded his prepared speech for the August Jackson Hole conference in favor of a “direct and forceful >message” that the Fed would do whatever it takes to suppress rising inflation.

“Without price stability, the economy does not work for anyone,” Powell said during his speech last month in Jackson Hole. “Reducing inflation is likely to require a >sustained period of below-trend growth.”

The market rally had already stalled out by the time Powell was lecturing the markets in Montana. His blunt remarks underscored that the interest rate hikes would not >end soon and that the Fed was prepared to slow the economy, if necessary, to kill inflation.

Underscoring the point, the August consumer price index (CPI) report, released in mid-September, showed that inflation is barely cooling off in the U.S. CPI remained >higher in August, up 8.3% year over year—analysts had expected the figure to drop to at least 8%. (Forbes)

From the point of view of Fed officials, enforcing another price hike seem justified, as “inflation” seemed to be on the rise. In decreasing the prices, there would be an increase in consumer spending, however the effects of this decrease are detrimental.

An Amateur’s POV

As mentioned in my previous blog, the stock market is something that I am fairly new to. However, entering at this period of time as one that was quite a rollercoaster ride as I experienced the front lines of stock market plunges. Though there are multiple factors that may have influenced this decrease (in my journey specifically,) red is all I see. Nike for example, is a great example of this plunge.

Looking back, NKE (Nike) seemed like a great idea as previous years showed promise.

As someone that actively browses Nike, purchasing NKE within the fourth quarter was something that quite appealing. Within the month of October, Nike has been known to release new shoes as people flock to stores in hopes of securing new shoes. Comparing the times of these releases with previous years of NKE stock, there was a similar relationship between the two. Though there may have been other factors that resulted in this increase, increases in the stock that happened to be around there is a new release is quite a coincidence.

As of writing this, calling the shots on the future of this stock seem a little idiotic, however, the current state of NKE is in shambles. Looking at the beginning of year, the stock has been on a steady fall.

Nearly dropping ~50% from its peak in November 15th of last year, the stock has been dropping ever since. Looking forwards to the earnings report day (September 29th,) all we can hope for is an increase in earnings compared to last year.

Looking at the stock market now, I have still have plenty to learn. Recognizing patterns and fully understanding the ins and outs of the stock market are still something that I continue to work on. Despite the drawbacks of losing money on my first year in the market, this plunge offers me opportunities for what to watch out for. Although it is still too early to finalize any thoughts, I hope to stock market makes a recovery…

Or maybe not.